Expert Debt Recovery Lawyers in London with 95% success rate

We help individuals and businesses with unpaid and disputed invoices. We understand that unpaid debts and payment disputes can affect your cash flow and create uncertainty for you and your business (and staff).

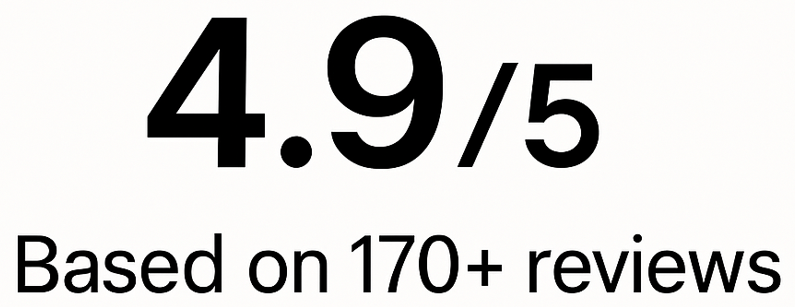

Our lawyers and specialist mediators have a high success rate of around 95% in successfully settling claims for clients, and most are resolved within a few months of our instruction due to our proactive and unique approach to litigation.

We will work collaboratively with you to agree on a strategy at the outset to resolve your debt issue. We specialise in secured and unsecured debts, guarantee and indemnity claims, book debt collections, rent arrears and/or service charges. We also provide practical advice to help you recover your debts as quickly as possible and with minimal or no cost to you, and make sure debt issues are minimised in the future.

We also provide a free initial case review and business health check to establish how we can help your business get your bills paid. If you have any unpaid debts, our specialist debt recovery lawyers will provide you with a cost-effective debt recovery service to get your debt paid quickly.

UK Debt Recovery

Our lawyers have acted for various clients in recovering debts within the jurisdiction. We are experts in our approach to getting debts paid quickly and resolving disputes between parties.

If you have a debt dispute in the UK, please do not hesitate to contact us for a Free Consultation today to discuss how we can assist you.

International Debt Recovery

Our lawyers have acted for clients in various cross-border and international debt recovery matters. We have a network of asset tracers globally to investigate the assets of an individual or business to inform the strategy to recover your debt.

Our lawyers have extensive knowledge of international agreements and treaties to assist in recognising judgments and debt internationally.

If you are based abroad or wish to pursue an individual or business outside of the UK, please do not hesitate to get in touch with us for a Free Consultation.

Asset Tracer & Due Diligence

Asset tracing and due diligence at the outset can be very important to navigate the strategy of pursuing the debtor and protecting your interests against an asset at the outset.

Our lawyers have an extensive knowledge base and network of asset tracers and tools which we utilise to inform the strategy on your case from the very outset. We will use these tools to assist in resolving your debt dispute quickly and cost-effectively.

Many of our asset tracers work with our clients at discounted rates, please do not hesitate to get in touch with us for a Free Consultation.

Specifically, our debt recovery and insolvency lawyers provide the following services:

- Business Health Check

- Reducing Debtor days

- Pre-litigation processes to encourage early payment including Letter before Claim

- Reviewing Business Contracts & Invoices

- Asset Tracing Reports (incl. HM Land Registry)

- Company Due Diligence (incl. Credit Safe, Companies House)

- Debt Collection

- Issuing Legal Proceedings

- Mediation & Expert Negotiation

- Settlement Agreements

- Statutory Demands

- Winding Up Petitions & Bankruptcy Petitions

- Debt Advice (incl. Personal Guarantees)

Case Example – £2m+ recovered in 1 month

Our lawyers regularly act for individuals and businesses to recover and dispute unpaid debts. Our lawyers were instructed by one such client within the construction industry that had several payment applications totalling over £2m outstanding for some time.

Given our unique approach to litigation, we quickly recovered the payment applications in full (plus 100% of our legal costs and interest) within 1 month of being instructed.

Our lawyers were so thorough and forward thinking that the debtor was impressed and wanted to instruct our lawyers on other unrelated matters. Our lawyers have garnered a lot of praise from the opponent for our unique approach which strengthens our client’s positions.

Winning Approach to Debt Recovery

Our lawyers’ extensive industry-specific knowledge and our commitment to justice make us the preferred choice for many clients seeking to resolve unpaid debts.

Our lawyers are recognised among the best lawyers in England & Wales, and have regularly been asked and featured to write authoritative articles in the Financial Times, the Law Society and LexisNexis and have been quoted in City AM, the New Law Journal, Law Society Gazette and Litigation Futures. Our unique approach means that we will:

- Arrange a Free Consultation with you & a qualified lawyer to discuss your debt concern

- Arrange a WhatsApp group with you & your legal team in case you have any ad-hoc questions

- Investigate the merits of your debt issue & devise a strategy for success at the outset

- Analyse Credit Safe and other legal platforms to inform our strategy for your payment dispute

- Advise you on any judgments & tactics that have proved successful on other debt disputes (incl. cases vs the debtor)

- Arrange for asset tracers to be instructed at discounted fees to investigate any security of assets to inform approach on enforcement

- Free sign-up to our Insolvency Tracker & Claims Protection service (worth £200 pa)

- Fixed fees & “no win no fee” funding options

- Work hard to achieve the best outcome

Our lawyers offer regulated, independent & confidential legal advice and are dedicated members of the Professional Negligence Lawyers Association, the London Solicitors’ Litigation Association, the Association of Cost Lawyers, the Insolvency Lawyers Association and the Commercial Litigation Association.

Mediation in Debt Disputes

Alternative dispute resolution, where suitable, provides many advantages for parties in legal disputes. Our lawyers are strong advocates for mediation which can often lead to favourable settlements.

Several of our lawyers are trained mediators and expert negotiators who are registered members of the Chartered Institute of Arbitrators (CIArb) and the International Mediation Institute. Our expertise in mediation gives our lawyers a significant and unique advantage when navigating settlement discussions on your behalf.

Fixed Fees & Flexible Funding Options

We provide flexible funding options including fixed fees and ‘no win no fee’ arrangements for your payment dispute.

Whether you are an individual or a business, we provide exceptional legal services at cost-effective prices: this is our promise.

To book a Free Consultation with our expert debt recovery lawyers, you can call us on 0207 459 4037 or you can use our booking form below.